As a systems developer, one of my research interests is the development of systems for investing in and trading the financial markets. Leveraging both my engineering background and practical trading experience, I’ve developed a balanced and holistic methodology which also encompasses human factors and psychology. The following articles describe this methodology:

- Find Your Niche by Developing Balanced and Individualized Trading Systems

- 10 Specific Tactics to Become a More Patient and Disciplined Trader

Matt Zimberg of Optimus Futures read these articles, and reached out to me for a live interview. Matt is a futures industry veteran and an encyclopedia of trading knowledge; he asked great questions and rounded out the discussion with his own unique insights and knowledge.

In the interview we discussed:

- Benefits of trading systems with frequent entry signals.

- Finding and researching new trading ideas.

- How systems fail and traders themselves can be the “weakest link”.

- Finding a balance with technical analysis.

- Computerized versus manual backtesting.

- The role of intuition and discretion.

- How to find an edge (both psychological and technical).

- Finding the right system for yourself (including timeframes, asset classes, etc.)

- Biggest struggles with psychology.

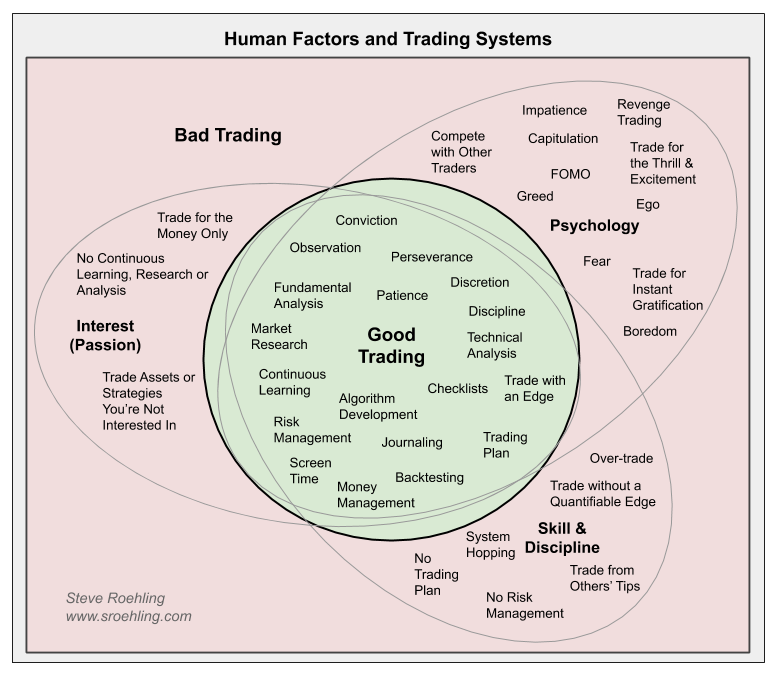

We also discussed a Venn diagram which emphasizes the importance of human factors and how a single failure can make the whole system fail: