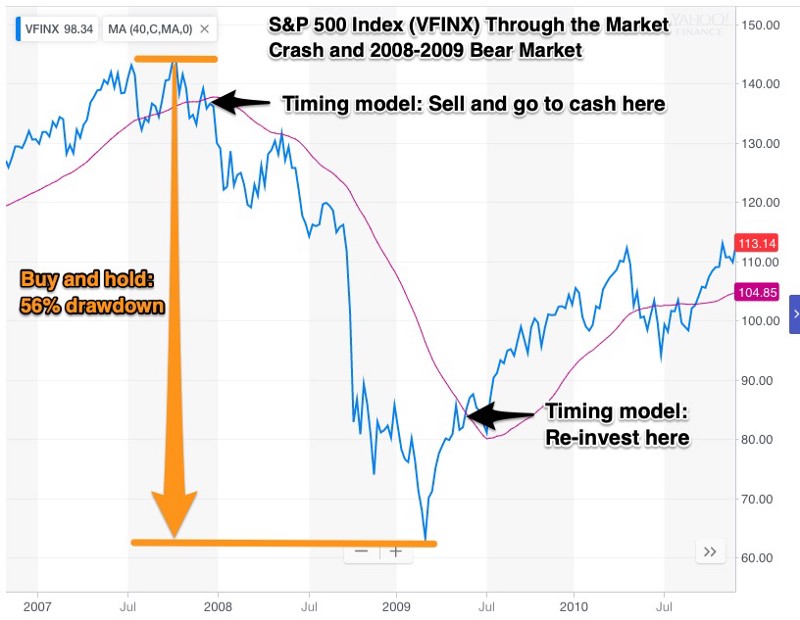

Leading into the market crash and bear market of 2008 and 2009, I was just beginning to learn about investing, trading and the financial markets. During this time, I took an interest in the work of Mebane Faber, who wrote a research paper about a very simple timing model to significantly improve the risk adjusted returns of long term investments.

Using this timing model, I took the S&P 500 index fund in my retirement account to cash when it hit the 10 month moving average. This single action prevented significant losses. Ever since, a variation of this timing model has been a mainstay of my long term investment strategy. Investing in the S&P 500 index is a simple example, but the timing model is also robust enough to work with different asset types, such as commodities and bonds.

A Simple Timing Model to Avoid the Worst of a Bear Market

Let’s assume you have your retirement account invested in an S&P 500 index fund, such as the Vanguard’s 500 Index Investor Fund (VFINX). A simple timing model basically works as follows:

- Sell rule: If the price crosses below the 10 month moving average of the fund’s price, go to cash.

- Buy rule: If the price crosses back above the 10 month moving average, re-invest in the fund.

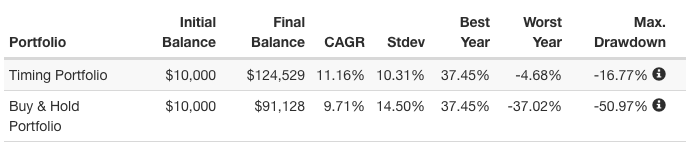

That’s it! If you back-test this simple strategy all the way to 1995, you can see the performance of this timing model through two different bear markets, and compare it with a buy and hold strategy:

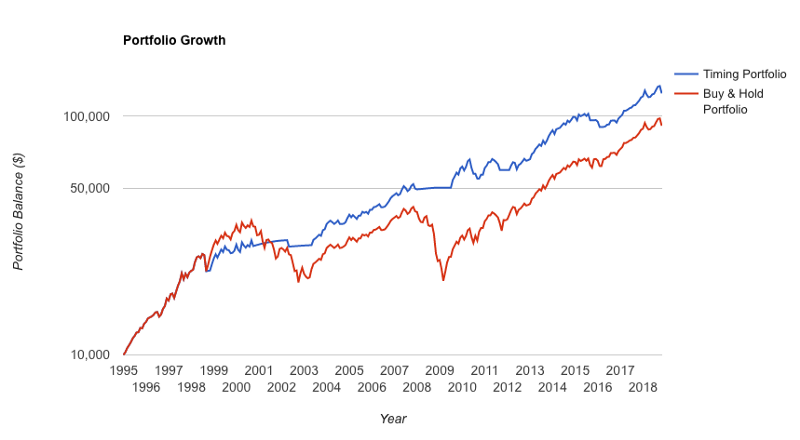

Below is a chart which also illustrates the performance of this simple timing model versus a buy and hold strategy:

Using a timing model, not only do the annual returns (CAGR) improve somewhat, but the maximum drawdown and worst year’s performance significantly improve!

The Importance of Investor Psychology

An investor using a buy and hold strategy from very top of the market in 2007, to the very bottom of the bear market in 2009 would have seen a drawdown of over 56%. On the other hand, someone who used a simple timing model would be in cash through the worst of the bear market.

In the long term, the annualized returns (CAGR) of a buy and hold strategy are not significantly different than a simple timing model. However, in the midst of a market crash and bear market, a 55% drawdown can be devastating to an investor’s psychology. For example:

- After experiencing a severe drawdown, an investor may “throw in the towel”, or capitulate and sell near the bottom of the bear market. Moreover, after capitulating, this investor will be in no mood to re-invest when the market begins to recover.

- An investor may be approaching retirement. For over 50% of their account to be wiped out by a bear market is devastating. Of course, as someone is approaching retirement, balancing their overall portfolio risk with bonds and other more conservative assets will help limit exposure to a stock market crash. Nonetheless, using a timing model, an investor can significantly reduce their risk exposure without negatively impacting returns.

- In the midst of a highly volatile bear market, it can be very jarring to experience the wild gyrations of a stock or mutual fund’s price. Using a timing model, one can sit out the worst of a bear market, and avoid the ongoing anxiety caused by market volatility. In other words, using a timing model can help an investor sleep better at night.

- After a drawdown of more than 50%, an account must achieve a gain of more than 100% gain just to break even. This recovery will take several years and further test an investor’s patience.

If It’s So Simple, Why Isn’t Everybody Doing It?

The timing model discussed herein is as simple as can be. However, putting this timing model into practice over a long period of 20 to 30 years is hard. It again boils down to psychology, but some reasons a system like this is difficult to implement include:

- Impatience: Undoubtedly one of the most challenging tendencies is an investor’s own impatience. It takes strong discipline and patience to stick with a system for many years. During that time, an investor may look around and see other traders and investors making more money using other strategies or in other types of investments. Or, the investor may experience a drawdown in their own system. In either case, there is a strong tendency to “system hop” to another system.

- Lack of discipline: However simple a timing model can be, it still requires an investor to monitor the price of the fund versus the 10 month moving average, and make occasional trades to go to cash or reinvest. Even though this could only result in a few trades per year, many investors prefer a “set it and forget it” approach.

- Conflicting investment advice: Individual investors will undoubtedly get investment advice from a variety of sources. For example, Warren Buffet is a proponent of a buy and hold strategy with the S&P 500 index, and favors this strategy not only for diversification but for tax purposes and minimizing fees; coming from Warren Buffet, this is not necessarily bad advice, depending on the individual investor and their investment timeframe. However, one lesson I’ve learned over the years is to learn how to do my own research and match the style of investing to my own psychology and risk tolerance; speaking for myself, a simple timing model which significantly reduces risk and may even improve long term returns is definitely the way to go.

- Tax implications: Depending on the type of investment account used with a timing model, there may be tax implications. I invest using a timing model within my tax-deferred IRA account, so taxes are only a concern after withdrawals.

Even though the implementation of a timing model over the long term can be challenging, there are a number of ways to persevere with a system like this. For example:

- Automate what you can: For example, with my broker, I can set up automated email alerts when the price crosses above or below the 10 month moving average. This alert serves as a reminder to either buy or sell my position, so I don’t have to constantly monitor the price. For me personally, and as simple as it sounds, an alert gives me more discipline to stick with a system; until I delete the alert from my email inbox, I know I need to go into my account and adjust my positions.

- Dedicate multiple investment accounts to different trading and investment systems and timeframes: The idea here is the leave one account solely devoted to investing with a timing model, but allow yourself to experiment with new systems and strategies in another account. I’ve found if I have a smaller account for short-term and/or experimental strategies, I’m far less inclined to “system hop” or abandon the strategy in my long-term investing account.

- Have a trusted 3rd party trade the system on your behalf: Ed Seykota, a pioneer in systems trading, is known to do this. Ed would design the systems but have a trader working under him implement the system and execute the actual trades; doing this allowed him to stay more emotionally detached from the ups and downs of the system and trade the system in a disciplined manner. This may not be practical for individual investors with small accounts, but it goes to show even the world’s top investors and traders need help with their discipline and emotions.

Now is the time to Prepare for the Next Bear Market!

After the market crash in 2008 and low point in March of 2009, the stock market has been in an extended bull market. At the time of this writing (November, 2018), there’s no predicting when the next bear market will occur; the only certainty is that a bear market will return at some point.

A key message from personal self defense training is to prepare yourself and know how to react before you are faced with a worst case scenario. I believe this type of message applies equally to investing. You need to prepare yourself beforehand, rather than make hurried and emotional investment decisions in the midst of volatile and rapidly deteriorating market conditions.

The timing model discussed herein offers investors a simple and time-tested strategy to achieve superior risk adjusted returns. Versus a “set it and forget it”, buy and hold type strategy, these types of systems do require more patience and discipline to implement. However, for many individual investors, it is definitely worth the extra effort to minimize risk exposure while still achieving very respectable investment returns.